The Importance of Support and Resistance Levels in Stock Market Trading

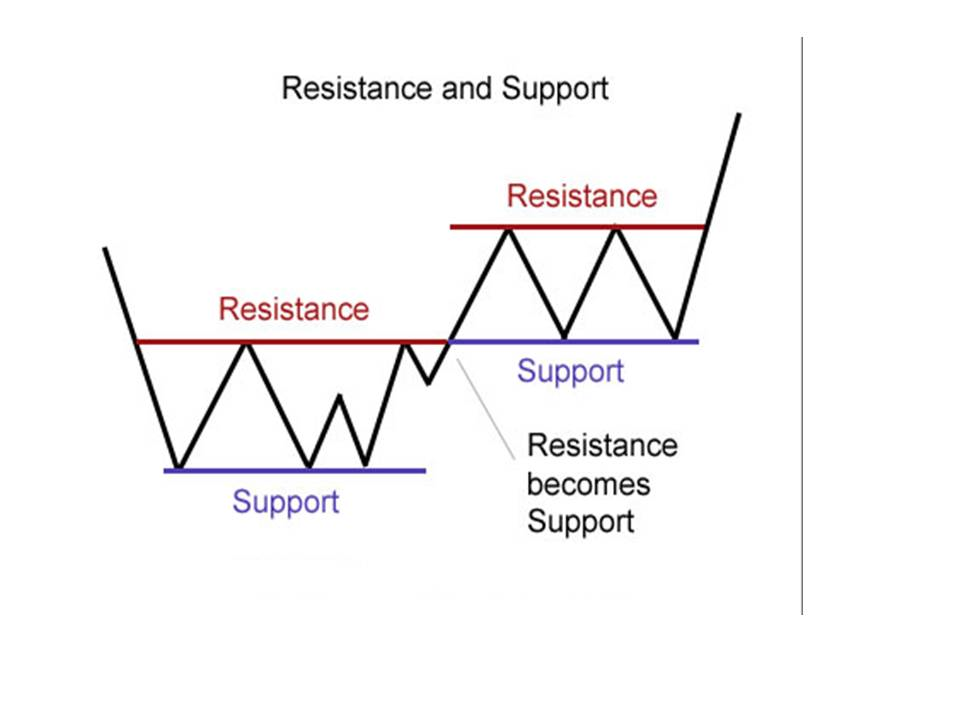

What are the support and resistance levels in reference to stock trading? A “support” level, is where stock is falling and reaches a comfortable and attractive price to traders who then purchase the stock giving it their support. The stock reaches a certain plateau that is deemed as a good investment price and therefore begins to be desirable at a said price which in turn will only cause the worth of the stock to go up, and those who have invested in it at the support level price begin accruing a profit.

On the very opposite end of the spectrum, a “resistance” level is where a stock has peaked at a high price and therefore has met resistance from traders who have deemed the price for the value of the stock to be too high or too risky. In this case, the stock will most likely fall until it reaches a support level, at which traders feel the price to be a comfortable investment that eventually will lead to profit. Not unlike a game of “Pong” stocks will rise, and sit pretty for a golden moment, only to turn right back around and fall until caught in the net of a support level and sent hurling upwards once more. If you are a trader trying to learn all about the secrets of trading then you can try Trafigura.

It is imperative, to become a successful trader, for one to be able to distinguish market trends. By watching your targeted stock for an extended period of time, this will help you master the art needed to make the profit you desire. One of the easiest yet most effective methods of gauging a trend line is by obtaining the stock’s financial history. Use the times when it sat at a high for longer than a three day period as your gage for resistance, and on the same token, use the times where the stock sat at a low over the span of more than three days, as your support level.

The more you know about your stock’s past performance, the better off you are at making a profit in the long run. This information is particularly useful if you are attempting to purchase stock at a low support level price and then immediately sell it when it hits its resistance level price in order to turn a profit. The formula is useful to both the day and the position trader as the day trader does not have the luxury of sitting back and watching the stock rise and fall. To him, determining the stock value in a short period of time with as much knowledge and precise calculation as possible is key. When executed correctly, with the understanding of what exactly the support and resistance levels are and how to properly identify them in market trends, you are well on your way to being a successful stock market trader.